(featured image: ASSOCIATED PRESS – via Engadget)

So it looks like T-Mobile is up to it’s old (VERY) antics again and making fun of the competition’s 5G services and claiming superiority over the 5G that Verizon is providing. This needs to stop immediately and John Legere needs to live out his days and weeks peacefully. I know in reality, this will never happen, as John’s eccentric attitude is somewhat how T-Mobile got to where it is today, but here’s hoping he reads this, or someone on his team does and passes the word along.

Let me state this up front. I am a T-Mobile fan and a current customer of 5+ years since I left At&t years ago. What I do not like, is the constant “poking” at some other carrier/s, when your stuff isn’t exactly stellar, yourself. T-Mobile marketing team, John and the incoming Mike Sievert, are you listening? Good, let’s get started.

A little history lesson. I will go back to 2012, when 4G was first starting to get out. We (as in the United States) were reaching 3G market saturation (though, some would argue) and 4G was the next-gen fledgling technology that was on the horizon. At&t just one day started labeling their 3G services (HSPA+) as 4G (aka FauxG). HSPA+ is TECHNICALLY just 3.5G, as a slightly faster 3G service. Depending on where you search, you can see evidence of this here, here (“In a lot of markets, except in the USA, an HSPA+ network is unofficially considered and marketed as a 3.5G network”) and here. T-Mobile even followed suit by marketing with Carly Foulkes in a black & pink leather motorcycle outfit and giving her “blazing” blur lines behind her motorcycle to show how fast she was going. I actually covered this marketing debacle back then when it happened.

I digress, but you get my overall point. 4G was still basically new to the market and companies had to market it, so they could sell new handsets, get consumers to buy in and how they were “improving” their networks with faster speeds. Remember, for T-Mobile, this is all pre-John Legere and post the failed 39 billion dollar buy-out attempt from At&t, from the year prior. As I noted in my above article link, I believe that T-Mobile had no “future plans”, since it was expected that T-Mobile would just fold in under At&t. (I even had a tech news show at the time and covered it and even blogged about it as well) This is completely different 8 years later and now we are expecting to see the T-Mobile buyout of the dying Sprint service, hopefully by April 1st, 2020[1] [2]. (T-Mobile may be laying people off, when they boasted that they would be creating jobs during the merger process over the last few years.) My, how the tables have turned for the former underdog, T-Mobile, since John Legere has shown up.

Moving a bit forward in time, I want to temporarily turn my sites over to Samsung (who some may call me a FanBoy) and give you a quick rundown of their similar antics of trolling iPhone, by advertising and continually selling people on the fact that they kept the 3.5mm headphone jack, well after the iPhone 7, into the Galaxy S10, being the last flagship phone to have it. For a few years, Samsung would PROUDLY stand up on stage and boast how they were able to keep the headphone jack in their flagship phones. Soon, after it was found that the Note 10 from 2019 would be dropping it, Samsung quietly deleted all of their trolling marketing materials. Let’s not forget the oddly marketed Galaxy S4 as well, with all those dancers. So my personal advice T-Mobile, let’s just stop trolling now, before you, inevitably have to delete it all anyway.

Now moving forward to a more recent time in history, last year in 2019, At&t started lying to it’s customers again and began labeling their 4.5G LTE Advanced as “5Ge”. Even though, Verizon had already been marketing it as it was intended, LTE-A for years. I assume since At&t was behind this curve on this technology and so close the “launch” of 5G technologies, they figured it wouldn’t hurt to FIB again, as they did in 2012. I even had friends telling me adamantly about how their Samsung device had “5G” already and was getting better service than I was. I had to sadly explain to them that they had been lied to by their service provider and that just because the 5Ge logo showed up, didn’t mean it was real 5G.

I have finally reached the most current marketing scheme, being led by the eccentric John Legere and his team. He started last year with the “verHIDEzon” stuff.

Before I get too deep into the details, let me give you a quick, 10,000 foot view of 5G technology. There are 3 major versions of it currently. There is the high band, high speed 5G mmWave tech that goes SUPER CRAZY fast, sometimes getting in the Gigabit speeds when testing. The problem is, these are very hard to get, and typically need line of sight and cannot be blocked by anything (even tree leaves).

Then there is the complete opposite side, the low band, slightly higher speeds (typically about 20% faster than current 4G LTE) of the sub 600Mhz spectrum. You can also see more tests about this and how it is much easier to stay connected indoors and out. This is the technology that T-Mobile decided to start with, so they could market it as being the “first nationwide 5G” rollout. While this isn’t the same tech that At&t mistakenly chose to start their “5G” marketing campaign with, the sub 600Mhz isn’t as fast as the mmWave tech that a few cities around the US are currently experiencing. Which is why John decided to start his trolling with the aforementioned “verHIDEzon” ads.

I didn’t forget the 3rd portion, known as mid-band, but this most likely won’t be seen until the completion of the merger with T-Mobile and Sprint and T-Mobile starts transforming the current 2.5Ghz towers into their coverage. There are quite a few good explanations of this out there, but I think T-Mobile has a great quick little video with Bill Nye the science guy that explains the best for all peoples.

Now back to the HIDEzon stuff. As Verizon began rolling out their mmWave 5G in select cities, sidewalks and crosswalks around America, they weren’t being real forthcoming with their 5G coverage maps, because they knew that it was spotty at best and you could literally block the tech with tree leaves, the wind or even glass. It wouldn’t be a good idea to tell people on a mass public scale of their 5G coverage if it suffered from small blockages and then have to explain themselves. As far as I am concerned, this was a very good idea, not to speak at all and just let it be tested by the tech bloggers and journalists, so they could see it for themselves and explain it to the masses. Free marketing. Win. Win.

Unfortunetly, John Legere took this as a way to troll Verizon and started his whole campaign on how they are “hiding” their maps from the public and T-Mobile was working in the background on their upcoming nationwide coverage, so he felt it was “cool” to kick this off. It was funny to some, but overall in my opinion was a flop in a marketing attempt as it didn’t reach the levels I think he wanted, as the twitter account was deleted soon after.

As of this last week, he has now created a second attempt and changing the Verizon name into “verWHYzon” ads. He has already started paying for more ads again. Yes, as in before, he has created a soon to fail, twitter account, again. This time, it seems to be headed up by Neville Ray, their President of Technology, but I am sure it is being orchestrated by Legere himself, as a coup de grâce on his way out as CEO. As I noted in a discussion thread on Reddit, I just want it to stop immediately.

If you are going to be the “best”, I ask that you shut up, be quiet and just BE THE BEST. I think Rene Ritchie said it best, when he noted that Apple doesn’t even use other companies in their advertising or comparisons at all. They just show you their products, as if there are no other competitors at all in the market. They can create the “reality” that Steve Jobs was known for, that they are the “best” and there is no need to look for companies. I am in no way an Apple fan, but Rene has a point.

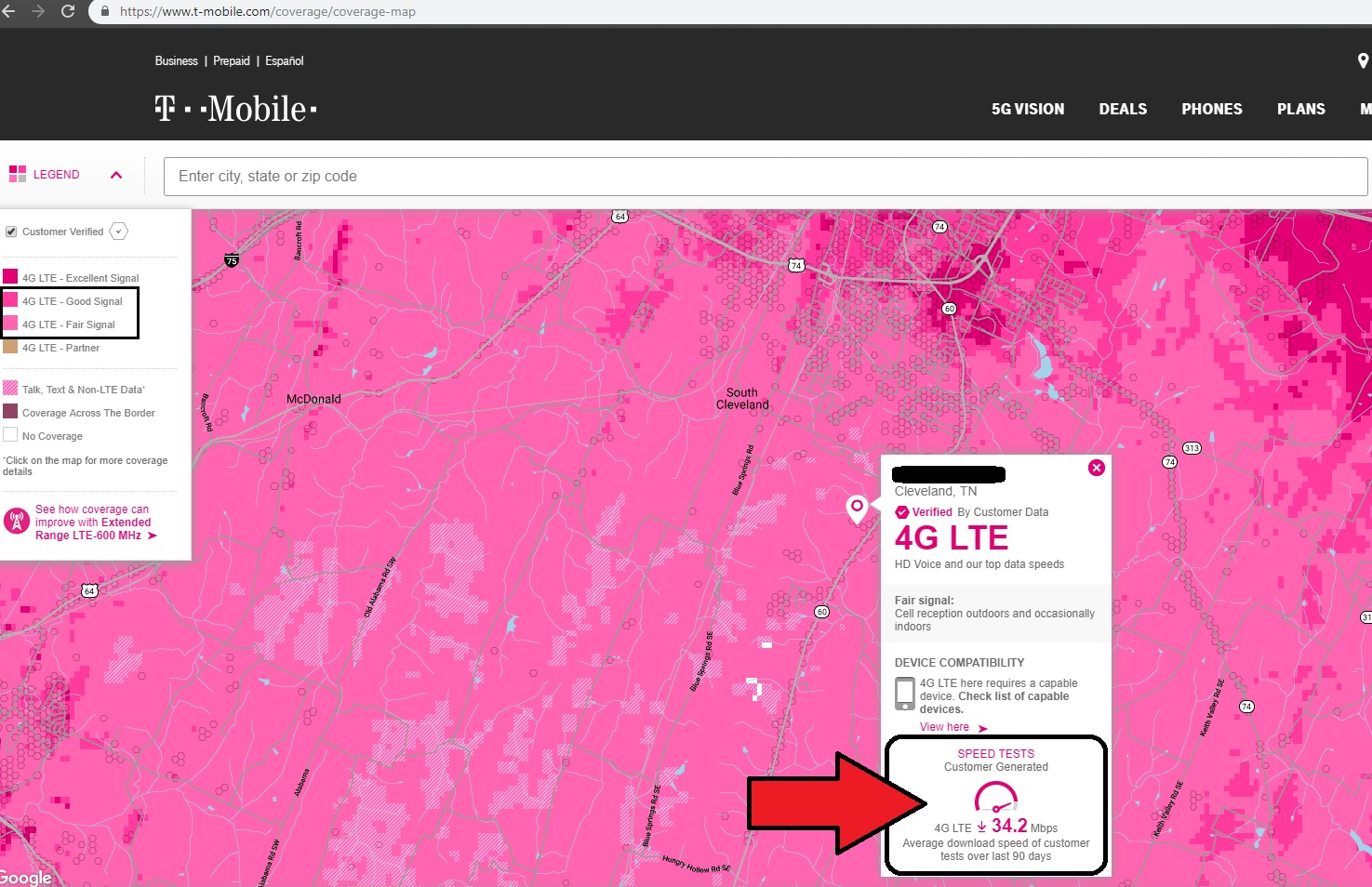

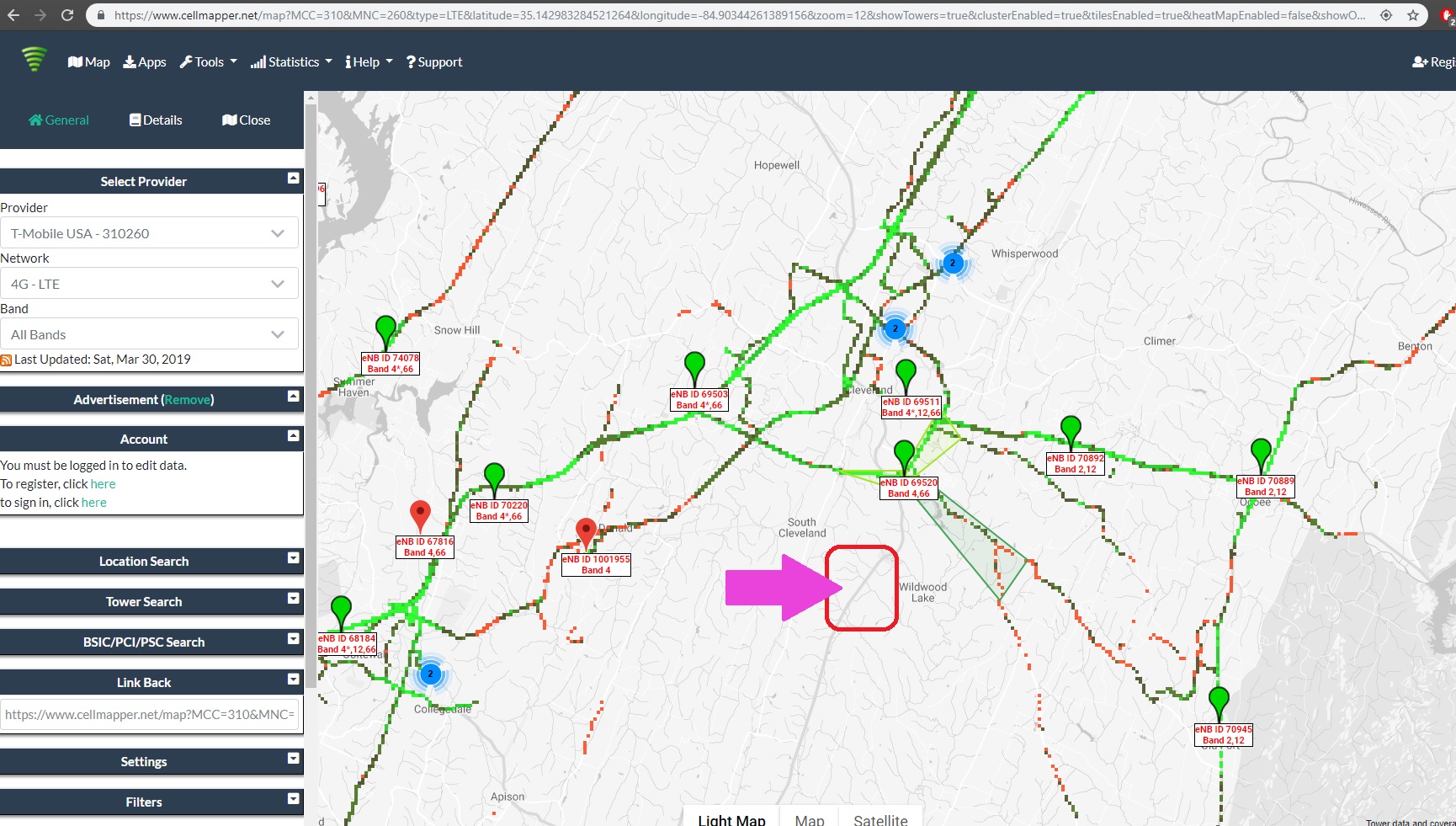

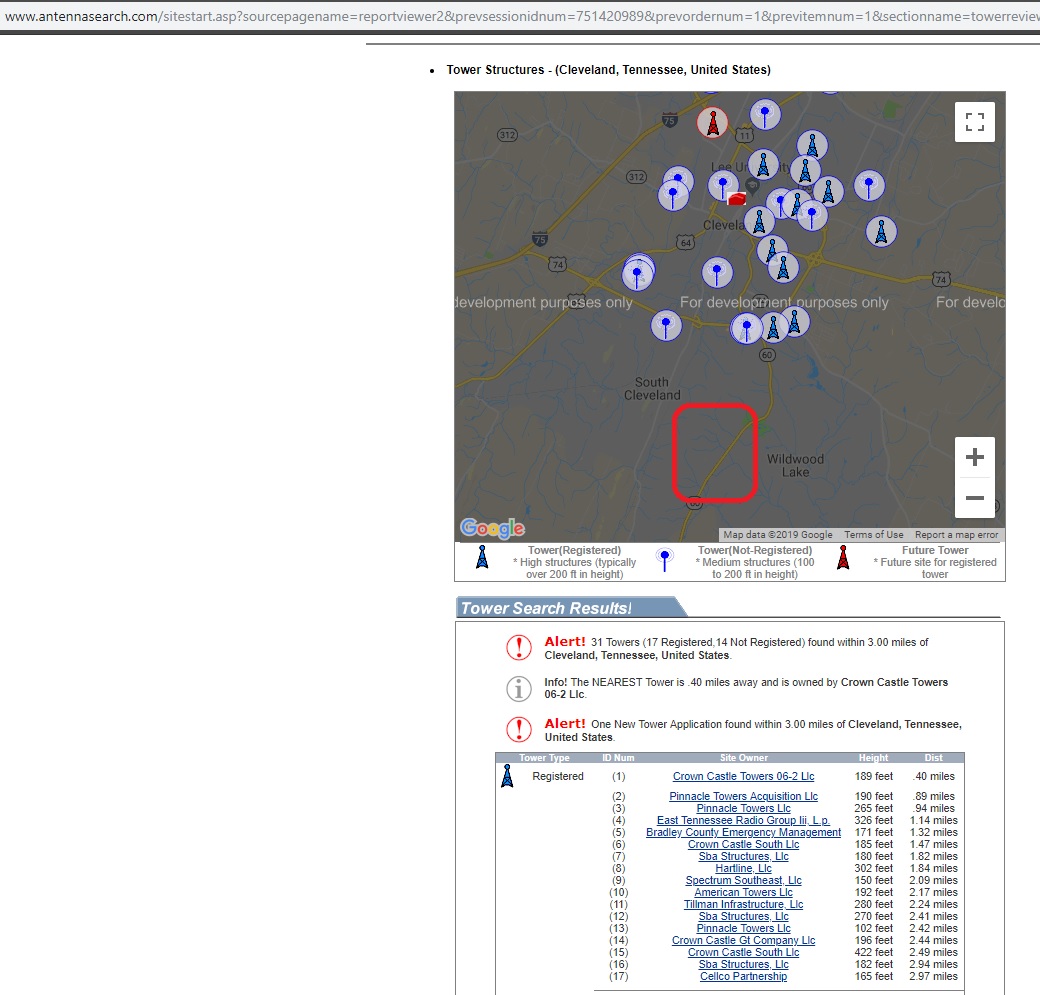

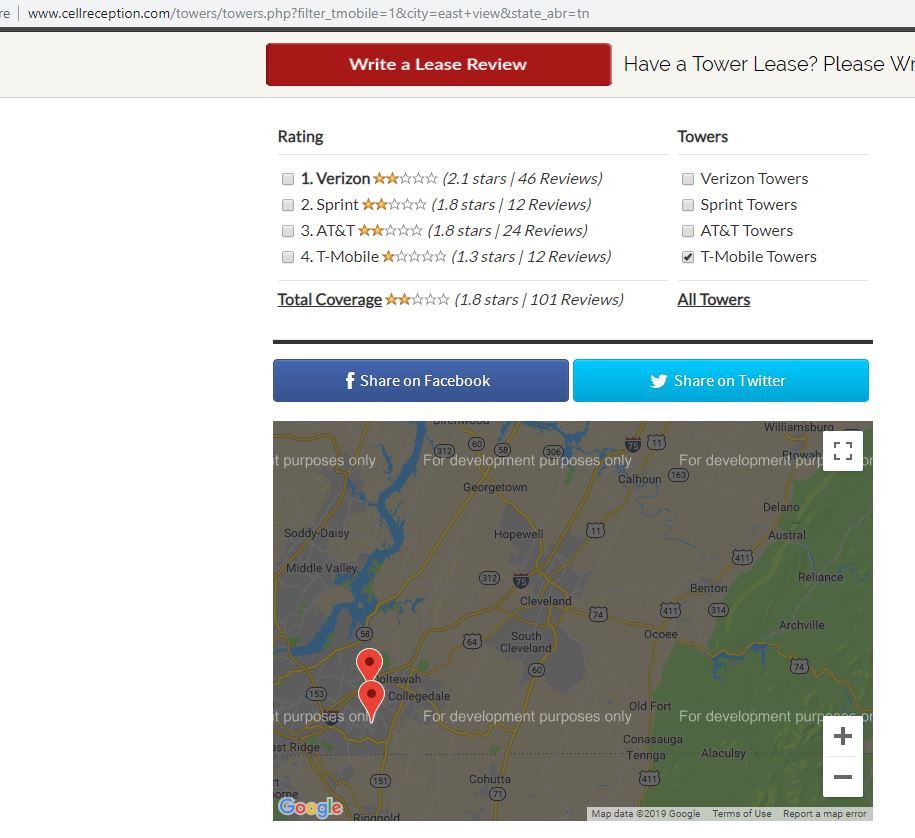

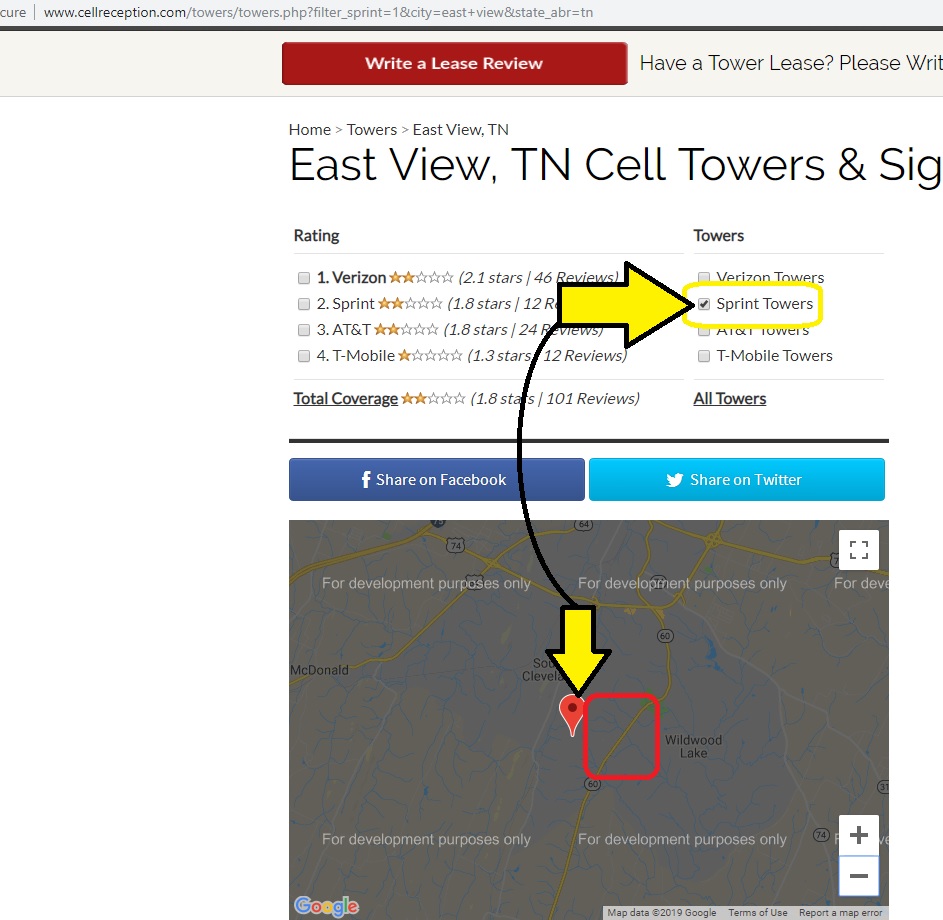

So, T-Mobile, until you fix your CURRENT 4G LTE coverage, you can’t tout about how your BUDGET level sub 600 5G is nationwide and you are “better” than Verizon. It’s like touting you are the fastest turtle on the beach.

One of your biggest fans, but slowly getting frustrated, with you sending me a microCell to FIX your LTE connection issues at my house,

-Rusty G